Hidden Perils of Insurance Total Loss Payouts on Sunk Boats

Did you know Insurance companies sometimes offer the owner of a total loss boat the opportunity to retain the vessel and accept a lower settlement?

In the vast expanse of the maritime world, boat ownership is an adventure filled with both excitement and risks. One such risk, often lurking beneath the surface, is the potential danger associated with insurance total loss payouts on boats that have met the unfortunate fate of sinking.

Contrary to common belief, an insurance total loss payout doesn’t necessarily mean the owner has forfeited the boat. In fact, it opens a gateway for a clandestine practice that poses significant dangers to unsuspecting buyers. Let’s delve into the complexities of this issue and unravel the potential hazards that come with it.

We explore the intricacies of insurance total loss payouts and the alarming practices that can follow.

Table of Contents

Retain the vessel and accept a reduced settlement

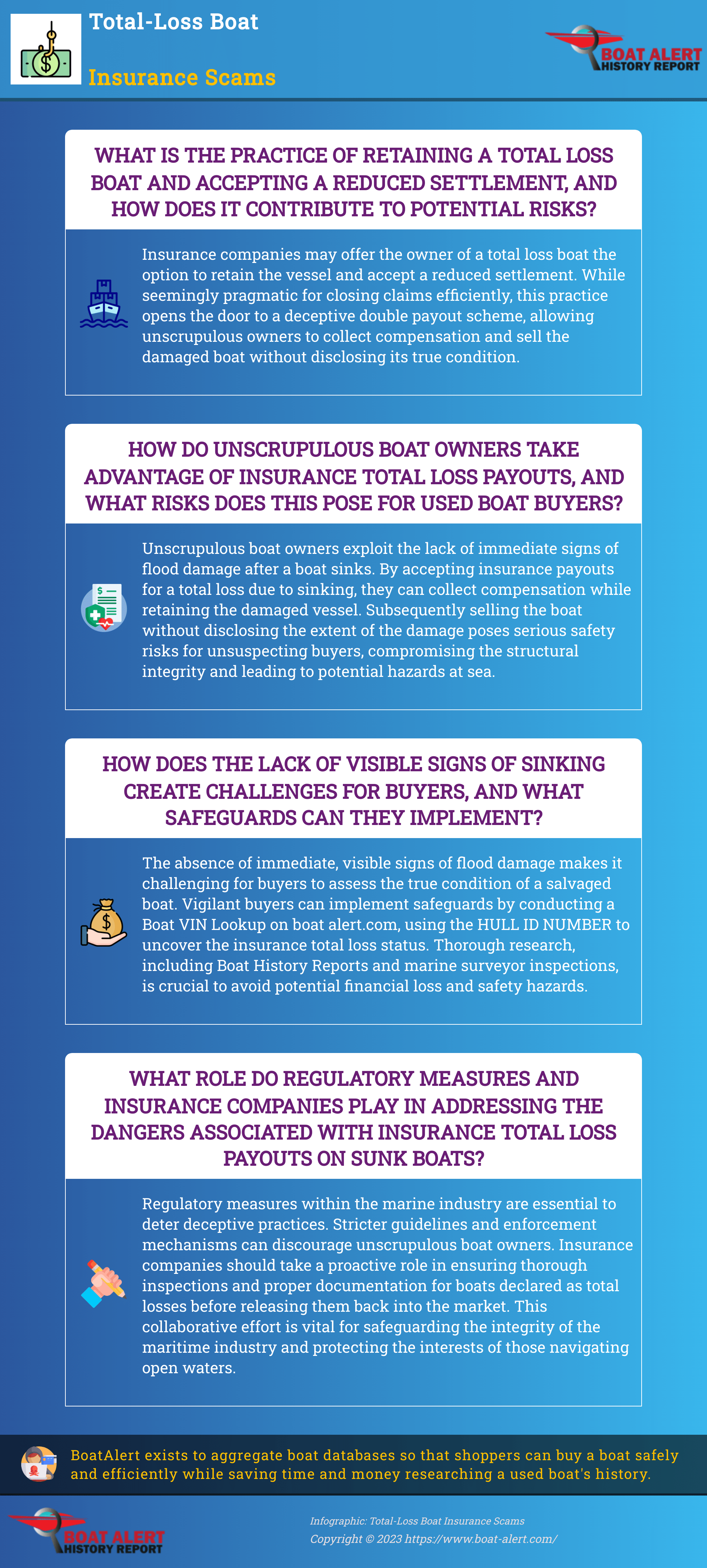

Insurance companies, faced with the burden of managing salvaged vessels, often extend an offer to the owner of a total loss or salvage boat: retain the vessel and accept a reduced settlement. This seemingly innocuous arrangement serves the insurance company well, allowing them to swiftly close the claim without the hassle of dealing with the salvaged boat.

However, what may appear as a pragmatic solution opens the door to a more insidious problem.

Scams faced by used boat buyers

When a boat is declared a total loss due to sinking, the immediate signs of flood damage might not be readily apparent. This presents an opportunity for unscrupulous boat owners to exploit the situation. By accepting the insurance payout, these owners can effectively collect compensation for their loss and still retain the damaged vessel.

The real danger lies in the subsequent act of selling the boat without disclosing the extent of the damage, resulting in a deceptive double payout!

The implications of this deceptive practice are far-reaching, affecting not only the unsuspecting buyers but also the integrity of the marine industry. Buyers, eager to embark on their maritime adventures, can fall victim to this hidden danger.

Purchasing a boat that has been submerged and subsequently sold without proper disclosure poses serious safety risks. The structural integrity of the vessel may be compromised, leading to a myriad of problems such as corrosion, electrical issues, and weakened hulls.

No Visible Sings of Sinking | sunk boats

The lack of immediate, visible signs of flood damage makes it challenging for buyers to discern the true condition of the boat. What may seem like a great deal on the surface could quickly turn into a financial and safety nightmare.

Imagine a family setting out for a weekend cruise, unaware that their newly acquired vessel conceals a history of submersion, putting them at risk of unexpected and potentially life-threatening incidents at sea.

Do a Boat VIN Lookup

Fortunately, vigilant customers can run a boat vin lookup on the boat-alert.com home page using the HULL ID NUMBER. With that, they were able to uncover the insurance total loss status of the boat they were interested in. This savvy move saves them from both financial loss and the potential dangers associated with operating a compromised vessel.

Our report can unveil the vessel’s past, including any insurance claims, accidents, or total loss declarations. Additionally, potential buyers should seek the expertise of marine surveyors to thoroughly inspect the boat for hidden damages that may not be immediately visible.

Deceptive Practices: A Double Payout Scheme

Furthermore, there is a pressing need for regulatory measures within the marine industry to address this issue. Stricter guidelines and enforcement mechanisms can deter unscrupulous boat owners from engaging in deceptive practices.

Insurance companies should also play a proactive role in ensuring that boats declared as total losses undergo thorough inspections and proper documentation before being released back into the market.

Clean Boat Titles

Unless your state has ‘carfax for boats’ law, then the salvage record will not be recorded on the title. Most states have clean titles for boats even if the boat is scrap metal!

Learn more about nmvtis and ucotva.

Conclusion

In conclusion, the dangers associated with insurance total loss payouts on sunk boats are real and pose a significant threat to unsuspecting buyers. The potential for double payouts incentivizes dishonest practices within the industry, putting both financial investments and safety at risk.

Vigilance, thorough researching the boat vin lookup on boat-alert.com, and regulatory measures are essential components in safeguarding the integrity of the maritime world and protecting those who embark on the open waters.

#salvage #boat #insurance #scams

Categories: To learn more about Boat-Alert.com History Reports for used boats and boat owner search visit: www.Boat-Alert.com