Boat Lien Search: How To Find Liens On a Vessel

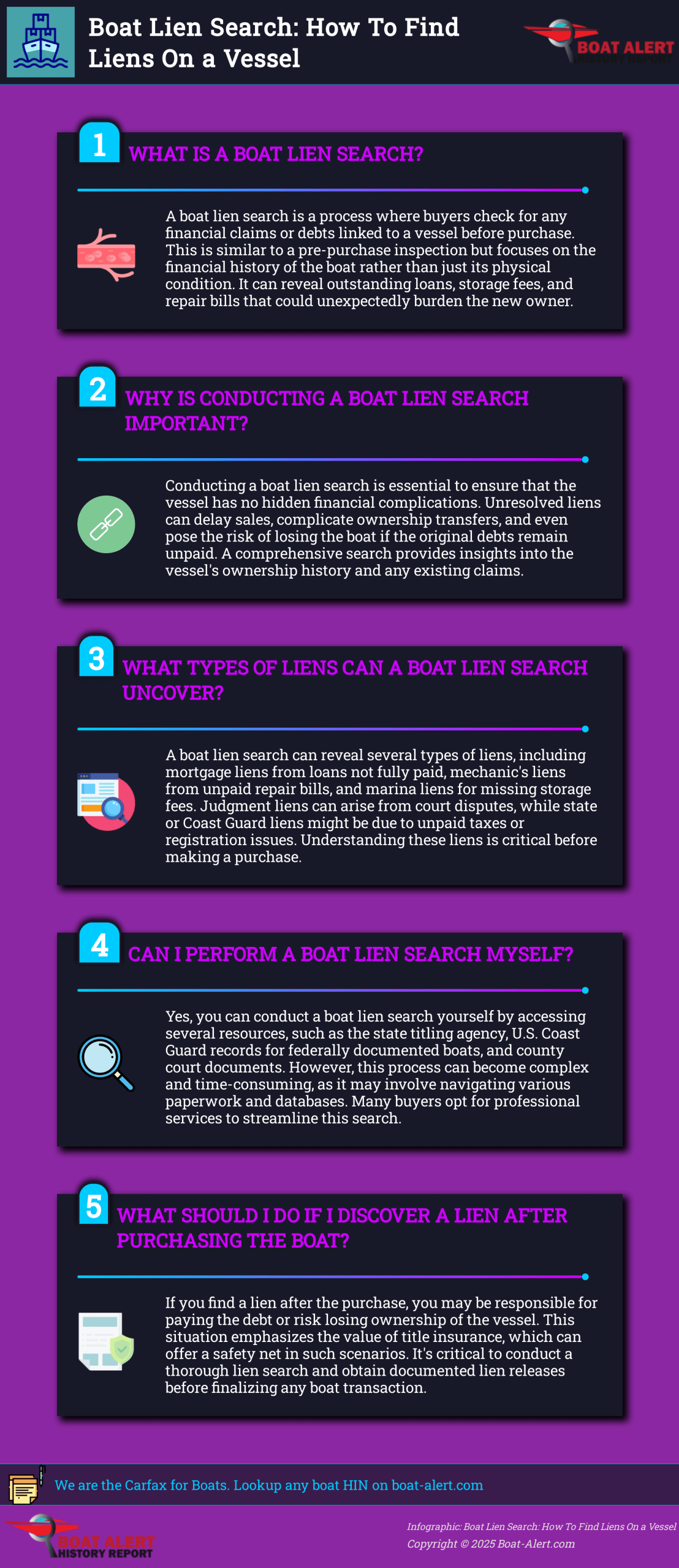

A boat lien search is essentially checking if a vessel you’re interested in buying has any outstanding debts or legal claims attached to it. Think of it as doing a pre-purchase inspection—not just for the hull or engine, but for the financial history. Liens could include unpaid loans, storage fees, marina charges, or even unpaid repair work.

Imagine buying the perfect boat, only to find out later that the previous owner still owed the marina thousands in docking fees. Now you’re on the hook. A lien search helps you avoid these costly surprises by revealing any existing financial baggage before the transaction is complete.

Why is a Boat Lien Search Important?

Doing a lien search ensures the vessel you’re buying is free of legal or financial entanglements. Hidden liens can delay the sale, complicate title transfers, or even result in you losing the boat if the original debt isn’t resolved. A full title search can provide a detailed picture of the boat’s ownership history and flag any liens or encumbrances.

Here are common types of liens a boat lien search can uncover:

- Mortgage Liens: If the previous owner financed the boat and hasn’t fully paid it off.

- Mechanic’s Liens: Filed by marinas or repair shops if bills for services or repairs haven’t been paid.

- Marina Liens: For unpaid docking, storage, or slip fees.

- Judgment Liens: Court-ordered claims that can attach to a vessel after legal disputes.

- State or Coast Guard Liens: If applicable, these can result from unpaid taxes, registration issues, or fines.

DIY vs. Professional Boat Lien Searches

You can perform a boat lien search on your own by checking with the state titling agency, the U.S. Coast Guard (for documented vessels), and county court records. However, it can be a maze of paperwork, databases, and dead ends.

That’s why many boat buyers prefer hiring professionals. They know where to look—state databases, court filings, national registries—and have access to tools that streamline the process. They can uncover red flags you might overlook.

How to Do a Boat Lien Search Yourself (Step-by-Step)

If you’re feeling adventurous and want to try it yourself, here’s a simple roadmap:

- Check the Boat’s HIN (Hull Identification Number): It’s like a VIN for boats—essential for tracking history.

- Search the U.S. Coast Guard National Documentation Center (if applicable): For federally documented boats.

- Contact the State Titling Office: To check for title-based liens and ownership records.

- Look Through County Court Records: To uncover civil judgments or court-ordered liens.

- Check With Marinas and Repair Shops: Especially where the boat was serviced or docked.

- Search for UCC Filings: Uniform Commercial Code filings may show loans secured by the vessel.

It’s doable, but time-consuming—and you might miss something critical.

Cost of a Boat Lien Search

A basic lien search for a vessel usually costs between $50 to $200, depending on the boat’s documentation status (state vs. federally documented), location, and whether you’re using a professional service.

To save money:

- Compare pricing from different lien search providers.

- Consider bundling it with a full boat history report since boat-alert sometimes has lienholder info.

- Use automated tools like Boat-Alert.com to streamline the process affordably.

Just keep in mind: cheaper isn’t always better if it means missing a costly lien.

When in doubt ask for an affidavit from the seller that there is no lien on the vessel. consult your nasbla administrator before signing any agreement as boat dealers and boat owners can miss things. vessel state title or vessel registration do not show lien usually, but this varies by state. they also don’t show salvage brands except for a handful of states.

Legal Details You Should Know About Boat Liens

Understanding the legal side of liens can help you make smarter buying decisions:

- Lien Priority: Some liens (like state tax liens) take precedence over others.

- Disclosure Rules: Not all sellers are upfront—so verify the lien status yourself.

- Lien Resolution: Liens must usually be paid off before the vessel’s ownership can be legally transferred.

- Lien Expiration: Some liens have expiration dates, but many last until the debt is settled.

Tips to Avoid Boat Lien Nightmares

- Always run a lien search before committing to a sale.

- Request a full boat history report (with lien status included).

- Ask for documented lien releases or payoff statements from the seller.

- Use a marine title service or escrow company when transferring ownership.

- Don’t skip title insurance—it adds an extra layer of protection.

Enhancing Your Vessel Lien Search Process

When purchasing a boat, conducting a thorough vessel lien search is critical to ensure the boat is free of liens encumbrances. A boat lien claims registry can provide detailed records of any outstanding claims against the vessel. By performing a boat documentation search through the USCG vessel documentation search at Vessel Documentation Center, you can access official records to verify the title status and confirm whether the boat is clear of financial obligations. This step is especially important when buying a boat from a private seller with a lien, as undisclosed liens could transfer financial responsibility to the new owner.

Checking Ownership and Registration Details

To check US Coast Guard boat registration ownership status, you can utilize the Coast Guard Port State Information Exchange or access records through the Vessel Documentation Center. These platforms allow you to find out who owns a documented boat by cross-referencing the hull identification numbers (HIN) and the boat’s certificate of documentation. The HIN, a unique identifier for each vessel, is critical for conducting accurate search lookups. Knowing the registrant details ensures you are dealing with the legitimate owner and helps avoid potential disputes.

Navigating Lien Records and Inquiries

Boat lien records are maintained by various entities, including the USCG and, in some cases, state DMV offices, depending on whether the boat is federally documented or state-registered. A lien status check status can be performed to confirm whether a lending institution has placed a lien on the vessel. When conducting a lien inquiry, be sure to check for any lien filing code associated with the boat, as this code can streamline the process of identifying claims. This ensures you have a complete picture of the boat’s financial history before finalizing a purchase.

Frequently Asked Questions About Boat Lien Searches

What if I find a lien after buying the boat?

You may have to pay the debt yourself or risk losing the vessel. This is why title insurance is a smart backup.

Can I buy a boat with existing liens?

Yes, but be cautious. Make sure the liens are paid off or accounted for before completing the deal. Read more on this here: Buying a Boat from a Private Seller with a Lien.

Will a lien affect my ability to register the boat?

Yes. Many states and the Coast Guard won’t process registration until all liens are cleared. If you have a Coast Guard documented vessel, order an abstract of title to make sure it shows ‘satisfaction of mortgage’ on it.

Do liens show up in a boat history report?

Some do—especially with services like Boat-Alert.com that pull from multiple data sources but do not over all lien databases. You can also check UCC Filings.

Is a professional lien search really necessary?

If you’re buying a high-value boat or a documented vessel, absolutely. It could save you from major legal and financial headaches later.

#lien #loan #boat #mortgage #SatisfactionOfMortgage

Read Related Articles:

- New Hampshire Boat Registration

- Texas Boat Registration

- Boat Buyer’s Guide to Brokers And Dealers

- How Boat-Alert.com Is Making the Used Boat Industry Safer Through Transparency and Data

- Best Step by Step guide to selling your Boat (How to sell a used boat)

Categories: To learn more about Boat-Alert.com History Reports for used boats and boat history reports by HIN visit: www.Boat-Alert.com