How Boat Financing Works

A Comprehensive Guide to Boat Financing: What You Need to Know

I love boats, and when I think back to when I first saw my dream yacht, I get really excited. But getting there wasn’t easy. I had to learn a lot about boat financing, which was new to me. I want to share what I learned, so you feel ready to deal with boat financing when you’re buying your own.

After reading this, you’ll know all about boat financing. You’ll learn about the types of loans and how to choose the best loan for you.

Key Takeaways

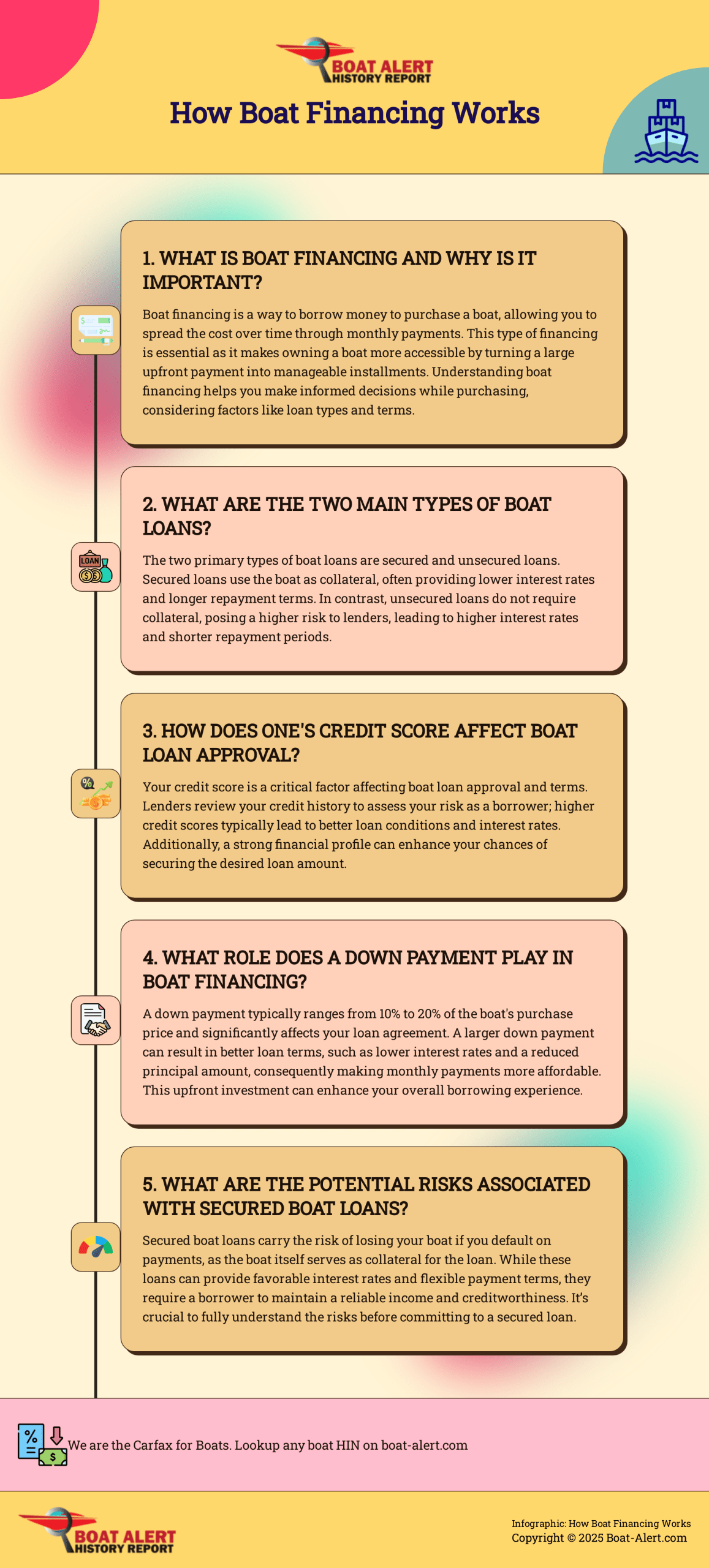

- Boat financing helps spread the cost of a watercraft purchase over time with monthly payments.

- Factors like credit score, income, and debt-to-income ratio impact boat loan approval and terms.

- A HIN lookup report from boat-alert.com can help identify the history of a used boat and avoid potential scams.

- Boat financing can have risks.

- Understanding the different types of boat loans and their requirements is crucial for making an informed decision.

Understanding Boat Loans

Boat loans help you buy marine vessels. They come as secured and unsecured loans. Knowing about these types of boat loans helps in making a good choice.

What Are Boat Loans?

Boat loans let you borrow the money to buy a boat, new or used. You pay back the loan in installments over 2 to 15 years. Some lenders might offer up to 20 years to pay back.

When buying a used boat you need to be careful it does not have money owing on the vessel. This is important to avoid scam on classified platforms. You also want to know the value of the used boat.

Types of Boat Loans

There are two main types of boat loans, secured and unsecured:

- Secured Boat Loans: These loans use the boat you’re buying as a guarantee. This can mean lower interest rates and more time to pay, up to 20 years. But, if you don’t keep up with payments, the lender can take your boat.

- Unsecured Boat Loans: These are like personal loans. There’s no need to risk the boat itself. They usually have higher interest rates and a 7-year limit to pay back.

- Home Equity Loans for Boats: You can also use your house’s equity to finance a boat. These loans might have lower interest rates, but not paying them back could mean losing your home.

Deciding on a secured or unsecured boat loan, or a home equity loan, depends on your finances, credit score, and how much risk you’re willing to take. Knowing the details of each option will help you pick the best one for your situation.

We always recommend reducing debt as much as possible in society.

How Boat Loans Work

Want to own a boat but need help with the money? Boat loans can make it possible. They cover everything from how much you can borrow to when and how you pay it back. The interest rates are also a key factor. They decide how expensive it will be in the long run.

Loan Amount

Need a boat loan? You might get from $1,000 to $100,000. The amount you can get depends on your credit and financial health. Lenders check things like how much you earn and how much you owe to see if they can give you a big loan.

Repayment Terms

When you borrow for a boat, you pay it back over 2 to 15 years. Some lenders let you stretch it up to 20 years. This affects the size of your monthly payments and the total interest you’ll pay.

Down Payment

Planning to buy a boat? You’ll probably need to put down 10% to 20%. A bigger down payment can get you a better deal. This means lower rates and easier terms for paying back the loan.

Interest Rates

Boat loan interest rates fall between 5% to 30% APR. Better rates go to those with great credit and a solid financial standing. The boat’s details and the lender’s risk view also influence the rate you get.

| Boat Loan Details | Typical Range |

|---|---|

| Boat Loan Amounts | $1,000 to $100,000 |

| Boat Loan Repayment Terms | 2 to 20 years |

| Boat Loan Down Payments | 10% to 20% of purchase price |

| Boat Loan Interest Rates | 8% to 35.99% APR |

Secured Boat Loans

Secured boat loans are a great choice for people wanting to buy a boat. They let you pledge the boat as security. This means you can pay back the loan over a long time, even up to 20 years. You might also get a good deal on interest rates compared to other loans.

The main good thing about a secured boat loan is the longer time to pay it back. This helps lower your monthly payments. It’s really useful for buying a big or costly boat. Creditworthy borrowers can even enjoy lower interest rates.

But, there’s a catch with a secured boat loan. The boat can be taken back if you can’t pay the loan. So, they are best for people with at least fair credit. They need to be able to make all payments. And, they should be okay with what happens if they miss payments.

So, secured boat loans are a great way to finance a boat for the long term. But, you need the right credit and financial situation. This is to be sure you can meet the loan’s demands.

Unsecured Boat Loans

Thinking about how to pay for a boat? An option is an unsecured boat loan, or a personal loan. Unlike loans secured by the boat, these unsecured boat loans let you borrow without risking your boat or anything else.

Because there’s no collateral, the interest rates can be higher. They’re good for people with good credit scores. But remember, you don’t have to put your boat up as security.

Personal loans for boats are often used for buying older boats or cheaper models. You can pay them off in up to 7 years. This way, you can get the boat you want without the worry of losing it if you struggle with your payments.

An advantage of boat financing without collateral is how flexible it is. If you have a good credit score and steady income, you can use this loan to buy your boat and even accessories. This makes owning a boat easier for more people.

Pros and Cons of Boat Financing

Boat financing has good sides and bad sides for those wanting to buy a boat. Knowing the pros and cons of boat loans helps you make a smart choice. This choice should match your money goals and your plans on the water.

Pros of Boat Financing

One big advantage of boat financing is it lets you pay off the boat over time. This means you don’t have to pay all at once. It makes owning a boat possible for more people. This also lets you might pay for other related costs like gear or maintenance with the loan. People with good credit might get low interest rates, which saves money over time.

Cons of Boat Financing

However, there are also downsides to boat financing. Getting a loan can be hard, especially with bad credit. If you use the boat as a guarantee, you could lose it if you can’t pay. Over time, you might pay a lot more in interest than if you bought it with cash.

It’s also important to remember that owning a boat means you need to pay for other things. This includes insurance, upkeep, storage, and gas. All these costs can add up, affecting your budget.

| Pros of Boat Financing | Cons of Boat Financing |

|---|---|

|

|

Where to Get a Boat Loan

Looking for a boat loan? There are many choices out there. You can try traditional banks or check out credit unions. Each option offers different loan terms and experiences. It all depends on what you’re looking for.

Banks Offering Boat Loans

Big banks and smaller ones alike offer boat loans. Some great places to look are Truist, U.S. Bank, and Bank of the West. Even Navy Federal Credit Union has you covered. They have special teams just for boat loans, which means you could get great rates and flexible terms.

Credit Unions Offering Boat Loans

Don’t forget about credit unions for your boat financing needs. Places like Navy Federal and USAA are known to help you out. They offer benefits and lower rates, especially if you’re in the military. With a focus on personal service, they might just have the right deal for you.

boat financing

The borrower’s credit score, debt-to-income ratio, and the boat’s condition impact financing. Lenders look for top-notch credit scores, steady income, and little debt. The boat’s age and value are crucial too. Older used boats might not get financed easily.

Factors Impacting Boat Financing

Scores and money matter a lot when you want a boat loan. Your credit score is vital. Lenders check how much you owe against how much you earn to see if you can pay them back. They also consider the boat’s age and shape. Often, banks don’t like to finance older boats.

Credit Score Requirements

Highest-quality boat loans need a stellar credit score. A score of at least 700 is good. It gives you a better shot at loan approval and low interest rates. Keeping your credit score high helps you get the best boat loans.

Applying for a Boat Loan

Applying for a boat loan works much like getting a personal or auto loan. You’ll need to share a lot of info about the boat and about yourself. The lender goes through all this info and might check your credit closely.

Information Needed

When applying for a boat loan, you should get ready to give out some key details:

- Details about the boat, including make, model, year, and price

- Proof of income, like pay stubs, tax returns, or bank statements

- Info about your money and debts, includes loans or how much you owe on credit cards

- A copy of your credit report and score

Application Process

The boat loan application process can be done online or in person. Lenders will look at what you provide to judge if you’re a good credit risk. They then decide on your loan amount, interest rate, and how you should pay back.

Getting all the right documents together can make the process go smoother. This can also help you get better loan terms for your dream boat.

A Guide to Refinancing Your Boat Loan

Refinancing your boat loan can offer significant benefits such as lower monthly payments, reduced interest rates, or shorter loan terms. Here’s a step-by-step guide:

- Evaluate Your Current Loan: Understand your existing loan details including interest rate, monthly payment, and remaining term.

- Check Your Credit Score: A higher credit score may qualify you for better refinancing rates.

- Define Your Refinancing Goals: Determine whether you want to lower your interest rate, reduce monthly payments, or shorten the loan term.

- Shop for the Best Offer: Compare refinancing offers to ensure they meet your goals. Use tools like Boat Trader’s loan calculator for estimates.

- Apply for Refinancing: Provide necessary personal and financial information, including income verification and boat details.

- Review and Accept the Offer: Carefully review the new loan terms, including any closing costs, and ensure they meet your refinancing objectives.

- Finalize the Loan: The new lender will pay off your existing loan, and you’ll start making payments under the new terms.

- When to Refinance: Consider refinancing if market rates have dropped, your credit score has improved, or you need financial relief.

- Duration: The process can take a few weeks to a couple of months, depending on various factors and document submission efficiency.

Tips for Boat Financing

When you’re getting a boat, take time to compare loan rates from different places. This shopping for boat loan rates technique can get you a great deal. Don’t forget about the costs of owning a boat. Include slip fees, upkeep, insurance, and gas in your budget. Doing this ensures you can afford the boat in the long run. Shop around for boat loans first.

| Tip | Why |

|---|---|

| Shop Around for Best Rates | Look at interest rates and terms from many lenders to find the top financing deal for your boat. |

| Consider Ownership Costs | Think about the ongoing costs of owning a boat like slip fees, upkeep, insurance, and gas to fit it into your budget. |

Timing Your Boat Financing

When you decide to finance your boat can really affect the total cost. Interest rates are always changing. So, getting a loan when rates are low can save you a lot of money. But, if you wait, the price of the boat might go up and cancel out your savings.

Interest Rate Fluctuations

Boat loan interest rates can be very different, from 8% to 35.99% APR. Lower rates mean you pay less interest over time. By choosing the right time to finance, when rates are lower, you could save a good amount of money.

Boat Price Changes

Boat prices change often, depending on the market. If more people are looking to buy boats, prices might go up. Waiting to buy might cost you more, even if you save on interest. But if prices are going to drop soon, it could be worth waiting.

Deciding the right time to finance your boat means thinking about interest rates and boat prices. Stay up to date and think about the risks and rewards to find the best deal for your purchase.

Warning!

When considering boat financing, be wary of lenders advertising the “lowest interest rates.” Although some lenders may offer rates as low as 3% or 3.5%, these can be misleading. These rates are often reserved for borrowers with excellent credit scores (800+), high incomes, and strong financial profiles. Moreover, such rates usually come with hidden fees and points due at closing, which may not be disclosed upfront.

Additionally, these low rates often come with short loan terms, which are not suitable for large purchases like boats. A short-term loan (e.g., three years) can result in high monthly payments. For instance, a $150,000 boat financed at 3.5% for three years would result in a monthly payment of approximately $4,395, excluding additional costs like insurance and maintenance.

Boat ownership is a dream for many, offering freedom on the water and endless opportunities for adventure. However, purchasing a boat often requires financing, and navigating the world of boat loans can be complex. This guide covers the essentials of boat financing, including loan terms, interest rates, credit requirements, and tips for securing the best deal.

Understanding Boat Financing

Boat financing works similarly to other secured loans, such as auto or home loans. The boat serves as collateral, and lenders offer loans based on factors like credit score, income, and the boat’s age and condition. Financing is available for new and used boats, including yachts and sailboats, with terms varying by lender and borrower qualifications.

Can You Finance a Boat?

Yes, you can finance both new and used boats. Financing is widely available through banks, credit unions, marine lenders, and even some boat dealerships. However, the ease of securing a loan depends on your creditworthiness, the boat’s age, and the lender’s requirements.

How Does Boat Financing Work?

A boat loan typically involves a down payment (often 10-20% of the purchase price), followed by monthly payments over a set term. The loan is secured by the boat, meaning the lender can repossess it if you default. Interest rates and loan terms vary based on the boat’s value, your credit score, and whether the boat is new or used.

Boat Loan Terms and Duration

Boat loan terms typically range from 2 to 20 years, with longer terms available for more expensive vessels like yachts. The average boat loan term is around 5 to 7 years, though terms can extend to 15 or 20 years for high-value boats.

- Short-term loans (2-5 years): These have higher monthly payments but lower total interest costs.

- Long-term loans (10-20 years): These offer lower monthly payments but accrue more interest over time.

- Average loan length: Most boat loans fall between 5 and 10 years, balancing affordability and interest costs.

Longer terms are common for new boats or borrowers with excellent credit, while older boats may have shorter terms due to their depreciating value.

Interest Rates for Boat Loans

Interest rates for boat loans vary based on the lender, your credit score, and whether the boat is new or used. As of 2025, average boat loan interest rates typically range from 4% to 8% for borrowers with good credit. Used boat loans often have slightly higher rates, averaging 5% to 9%, due to the increased risk for lenders.

- Why are rates high? Boat loans are considered riskier than auto loans because boats are luxury items and depreciate quickly. Economic factors like inflation can also drive rates up.

- New vs. used boat rates: New boats often qualify for lower rates, while used boats may have higher rates due to their age and condition.

- Lenders to consider: Navy Federal Credit Union, USAA, and US Bank offer competitive rates, often with online calculators to estimate payments.

Credit Requirements for Boat Loans

To secure a boat loan, lenders typically require a credit score of at least 600, though a score of 700 or higher will qualify you for better rates and terms. Key credit-related factors include:

- Credit score: A score above 700 is considered good for boat loans, while scores below 600 may require subprime loans with higher rates.

- Debt-to-income (DTI) ratio: Lenders prefer a DTI ratio below 40%, ensuring you can manage loan payments alongside other debts.

- Fair credit options: Some lenders specialize in loans for fair credit (600-660), though rates will be higher.

- Bad credit loans: Subprime boat loans exist but come with high interest rates and stricter terms.

Down Payment and Other Qualifications

Most boat loans require a down payment of 10-20% of the purchase price. For example, a $50,000 boat may require $5,000-$10,000 upfront. Additional qualifications include:

- Income verification: Lenders typically require proof of income, though some offer no-income-verification loans for qualified borrowers.

- Boat condition: Older boats (over 10 years) may require a marine survey to verify their condition and value.

- Other requirements: Stable employment, a low DTI ratio, and a clean credit history improve your approval odds.

Financing Older Boats

Financing older boats can be challenging, as many lenders limit loans to boats less than 10-15 years old. However, specialized marine lenders and credit unions like Navy Federal offer loans for older boats, often requiring:

- A marine survey to confirm the boat’s condition.

- A higher down payment (20% or more).

- Shorter loan terms (5-7 years) to account for depreciation.

Used Boat Financing

Used boat loans are widely available, but terms differ from new boat loans. Key considerations include:

- Higher interest rates: Used boats carry rates 1-2% higher than new boats.

- Shorter terms: Lenders may offer 5-10 year terms for used boats compared to 10-20 years for new ones.

- Boat condition: A professional inspection is often required to ensure the boat’s value.

Yacht and Sailboat Financing

Yachts and sailboats, due to their higher cost, often qualify for longer loan terms (up to 20 years) and may be financed through specialized marine mortgages. These loans function similarly to home mortgages, with the vessel as collateral. Key points:

- Higher credit requirements: Yacht financing typically requires a credit score of 720 or higher.

- Larger down payments: Expect 15-20% down for yachts.

- Marine mortgage specifics: These loans may involve additional fees, like title searches or documentation costs.

Boat Loan Process and Types

The boat loan process typically involves:

- Prequalification: Check your credit score and DTI ratio to estimate eligibility.

- Loan application: Submit financial details, including income, debts, and the boat’s details.

- Boat appraisal: For used or older boats, a survey may be required.

- Loan approval: Once approved, you’ll sign a loan agreement and make a down payment.

- Repayment: Pay monthly over the loan term, typically with fixed interest.

Types of Boat Loans

- Secured boat loans: The boat is collateral, offering lower rates but with repossession risk.

- Personal loans for boats: Unsecured loans with higher rates but more flexibility.

- Marine mortgages: Used for yachts or high-value boats, with terms resembling home mortgages.

Best Boat Loan Options

Finding the best loan depends on your credit, the boat’s age, and your financial goals. Top options include:

- Navy Federal Credit Union: Offers competitive rates and flexible terms for members, especially for new boats.

- USAA: Known for military-friendly loans with online calculators for easy planning.

- Specialized marine lenders: Companies like Trident Funding cater to older boats and yachts.

- Local lenders: Credit unions in areas like Missouri, Milwaukee, or Western Wisconsin may offer tailored options.

- Vancouver-based lenders: Marine-focused lenders in Vancouver provide options for Canadian buyers.

For excellent credit, look for lenders offering rates below 5%. For older boats, seek out marine specialists with experience in vintage vessels.

Refinancing a Boat Loan

Refinancing can lower your interest rate or adjust your loan term. It’s ideal if rates drop or your credit improves. The process mirrors applying for a new loan, requiring a credit check and boat appraisal.

Tips for Securing a Boat Loan

- Check your credit: Improve your score before applying to secure better rates.

- Shop around: Compare offers from banks, credit unions, and marine lenders.

- Consider a larger down payment: This reduces the loan amount and interest costs.

- Use loan calculators: Tools from Navy Federal or USAA help estimate payments.

- Avoid over-financing: Ensure monthly payments fit your budget to avoid financial strain.

Is Financing a Boat a Good Idea?

Fin bepalen of het financieren van een boot een goede beslissing is, hangt af van uw financiële situatie en levensstijl. Overweeg het volgende:

- Voordelen: Financiering maakt directe aankoop mogelijk zonder al uw spaargeld uit te putten, en vaste rentetarieven zorgen voor voorspelbare betalingen.

- Nadelen: Boten depreciëren snel, en langdurige leningen kunnen leiden tot hogere totale rentekosten. Zorg ervoor dat de betalingen binnen uw budget passen.

de beste deal te vinden. Met zorgvuldige planning kunt u genieten van het water zonder financiële stress.

Conclusion | How Boat Financing Works

Boat financing is great for people who want a boat but need to spread out the payments. It lets them pay bit by bit over time. This method makes it easier for them to own a boat.

People should look at different boat loan types, their terms, and what they need from the loan. This way, they can pick the best plan for them. Whether it’s a loan with the boat as a security or a personal loan without that, thinking about these things is smart.

Buying a boat involves many costs. So, it’s important to shop around for the lowest interest rates and pick the right time to take out a loan. Doing this helps buyers feel more sure about their choices. It makes owning a boat more enjoyable and less stressful financially.

Finally, getting a boat is a big deal for many. With the right financing, they can do it without much worry. This step allows boat lovers to start their boating journey in a good financial place. It ensures they have years of fun on the water ahead.

Frequently Asked Questions About Boat Financing

What are boat loans?

Boat loans help you buy a boat by borrowing money. You can get a loan that’s either secured or unsecured. Secured loans are safer for the lender because they use the boat as a guarantee. This way, they usually have better interest rates.

What are the types of boat loans?

There are two main kinds of boat loans. Secured loans use the boat as collateral. Unsecured loans, or personal loans, do not need any collateral.

You might also consider using your home’s equity to get a loan.

Is Financing a Boat a Good Idea?

Deciding whether financing a boat is a good decision depends on your financial situation and lifestyle. Consider the following:

Pros

Financing allows you to purchase a boat immediately without depleting your savings, and fixed interest rates provide predictable payments.

Cons

Boats depreciate quickly, and long-term loans can lead to higher total interest costs. Ensure the payments fit comfortably within your budget.

How Hard Is It to Get a Boat Loan?

With a good credit score (700+) and stable income, securing a boat loan is relatively straightforward. Older boats or lower credit scores may present more challenges.

Can I Use a Personal Loan for a Boat?

Yes, but personal loans typically have higher interest rates than secured boat loans.

How Long Can I Finance a Boat?

Up to 20 years for new or expensive boats, though 5-10 years is more common for used boats.

How much can I borrow for a boat loan?

You can borrow from $1,000 to $100,000 for a boat. The exact amount you can get depends on how good your credit is.

These loans are paid back over 2 to 15 years, but sometimes you can have up to 20 years to pay it back.

What are the typical down payment and interest rates for boat loans?

Down payments usually range from 10% to 20% of the boat’s price. Interest rates vary from 8% to 35.99% APR.

The rates you get depend on your credit score. Better scores mean better rates.

What are the benefits and drawbacks of secured boat loans?

With secured loans, you can pay back over a long time – up to 20 years. This means lower monthly payments. Also, you might get a better interest rate.

But, if you miss payments, the lender can take your boat.

What are the benefits and drawbacks of unsecured boat loans?

Unsecured loans don’t need the boat as security. So, you don’t risk losing the boat if you can’t pay. They are easier to get if you have good credit.

Yet, they often have higher interest rates and shorter payback terms of around 7 years.

What are the pros and cons of boat financing?

Boat financing lets you spread the cost over time. You can use the loan for the boat and related expenses. With a good credit score, you might get a low interest rate.

However, it can be hard to qualify for a loan. There’s always a risk with a secured loan – you might lose your boat. Also, remember that you’ll pay more over the life of the loan because of interest. Don’t forget about the extra costs besides the loan, like upkeep and insurance.

Where can I get a boat loan?

Many places offer boat loans. You can try banks, credit unions, or marine dealerships. Some big banks that lend for boats are Truist, U.S. Bank, Bank of the West, and Navy Federal. Credit unions like Navy Federal and USAA are good options too, especially if you’re in the military or are a family member.

What factors impact boat financing?

Credit score and debt-to-income ratio are very important. Lenders want to see that you have a stable job and can handle another loan.

The boat’s age and condition also play a role. Be ready to show you can afford everything.

What information is needed for a boat loan application?

Applying is like filling out a personal loan. You’ll need to share details about the boat and yourself. This includes your job, how much you earn, what you own, and what you owe. Plus, your credit score matters a lot.

How can I ensure I get the best boat financing terms?

It’s smart to compare rates from different lenders. This way, you can pick the best deal. Also, remember the other costs of owning a boat, like docking and repairs. Make sure you can handle those costs on top of the loan.

How does the timing of boat financing impact the overall cost?

Interest rates change all the time. Try to get a loan when rates are low to save money. But, remember that boat prices can also change. Waiting for lower rates could mean paying more for the boat itself.

It’s a balance between saving on the loan and the boat’s price.

,000 to 0,000 for a boat. The exact amount you can get depends on how good your credit is.

These loans are paid back over 2 to 15 years, but sometimes you can have up to 20 years to pay it back.

What are the typical down payment and interest rates for boat loans?

Down payments usually range from 10% to 20% of the boat’s price. Interest rates vary from 8% to 35.99% APR.

The rates you get depend on your credit score. Better scores mean better rates.

What are the benefits and drawbacks of secured boat loans?

With secured loans, you can pay back over a long time – up to 20 years. This means lower monthly payments. Also, you might get a better interest rate.

But, if you miss payments, the lender can take your boat.

What are the benefits and drawbacks of unsecured boat loans?

Unsecured loans don’t need the boat as security. So, you don’t risk losing the boat if you can’t pay. They are easier to get if you have good credit.

Yet, they often have higher interest rates and shorter payback terms of around 7 years.

What are the pros and cons of boat financing?

Boat financing lets you spread the cost over time. You can use the loan for the boat and related expenses. With a good credit score, you might get a low interest rate.

However, it can be hard to qualify for a loan. There’s always a risk with a secured loan – you might lose your boat. Also, remember that you’ll pay more over the life of the loan because of interest. Don’t forget about the extra costs besides the loan, like upkeep and insurance.

Where can I get a boat loan?

Many places offer boat loans. You can try banks, credit unions, or marine dealerships. Some big banks that lend for boats are Truist, U.S. Bank, Bank of the West, and Navy Federal. Credit unions like Navy Federal and USAA are good options too, especially if you’re in the military or are a family member.

What factors impact boat financing?

Credit score and debt-to-income ratio are very important. Lenders want to see that you have a stable job and can handle another loan.

The boat’s age and condition also play a role. Be ready to show you can afford everything.

What information is needed for a boat loan application?

Applying is like filling out a personal loan. You’ll need to share details about the boat and yourself. This includes your job, how much you earn, what you own, and what you owe. Plus, your credit score matters a lot.

How can I ensure I get the best boat financing terms?

It’s smart to compare rates from different lenders. This way, you can pick the best deal. Also, remember the other costs of owning a boat, like docking and repairs. Make sure you can handle those costs on top of the loan.

How does the timing of boat financing impact the overall cost?

Interest rates change all the time. Try to get a loan when rates are low to save money. But, remember that boat prices can also change. Waiting for lower rates could mean paying more for the boat itself.

It’s a balance between saving on the loan and the boat’s price.

Qualifying for a Boat Loan:

- Lenders require proof of financial ability to repay the loan, including credit rating, debt-to-income ratio, net worth, and liquidity.

- Check your credit report from Experian, Equifax, or Trans Union for accuracy before applying.

- Ideal debt-to-income ratio is around 40-45%.

- Net worth is calculated as assets minus liabilities, and liquid assets are those convertible to cash within 30 days.

Boat Down Payments and Ownership Costs:

- Down payments are typically 10-20%, but this varies based on the boat’s cost, value, and your finances.

- Lenders require sufficient cash reserves post-down payment to cover additional ownership costs like insurance, fuel, and maintenance.

- Interest rates depend on the loan term, boat age, and your credit history. Newer boats might offer better rates.

- Be aware of sales tax, title and registration fees, and other administrative costs.

Applying for Boat Financing:

- You’ll need bank statements, tax returns, and other documents demonstrating income, credit rating, debt-to-income ratio, net worth, and liquidity.

Affordability:

- Banks can assist in determining how much you can afford, and online calculators are available for estimating comfortable payments.

Credit Score Requirements:

- Higher credit scores (680+) are preferred for securing lower interest rates. Subprime lenders are an option for lower scores.

Loan Terms:

- Terms range from 24-48 months for trailerable boats to up to 240 months (20 years) for larger vessels.

Typical Down Payments:

- Generally, 10% to over 30%, depending on your credit score and financial profile.

- For a $70,000 boat, expect to put down at least $7,000 with excellent credit, and $14,000-$21,000 with lower credit.

Getting a boat loan can be a daunting task for many individuals, especially if they are unsure of the process. With so many factors to consider, such as credit score, income verification, and down payment requirements, it’s no wonder people may feel overwhelmed.

One of the most frequently asked questions when it comes to boat financing is, “Are boat loans hard to get?” The answer to this question depends on a variety of factors, including your credit score, income level, and the lender you choose.

For those wondering, “Can you get a loan on a boat without proof of income?” the answer is yes, but it may be more difficult to obtain. Lenders typically prefer to see proof of income to ensure you can repay the loan.

If you’re considering financing a boat with fair credit, you may be wondering how difficult it is to get approved. While it may be more challenging to secure a loan with fair credit, it’s not impossible. Lenders will also consider other factors such as your income and down payment amount.

For those interested in navy federal boat loans, it’s important to be aware of the requirements and rates associated with these loans. Navy Federal offers competitive rates for boat loans, but you must meet certain criteria to qualify.

Overall, understanding how boat loans work and what lenders look for can help you navigate the process with confidence. By being prepared and informed, you can increase your chances of securing financing for your dream boat.

Read Related Articles:

- Best Marine Surveyors in Sacramento

- How Do You Read a Hull ID Number (HIN)?

- Alabama Boat Registration

- All you need to know about stolen boats (Ultimate guide)

- How Boat Financing Works

Categories: To learn more about Boat-Alert.com History Reports for used boats and boatalert visit: www.Boat-Alert.com