How to Import a Boat to Canada

How to Import a Boat to Canada: A Comprehensive Guide

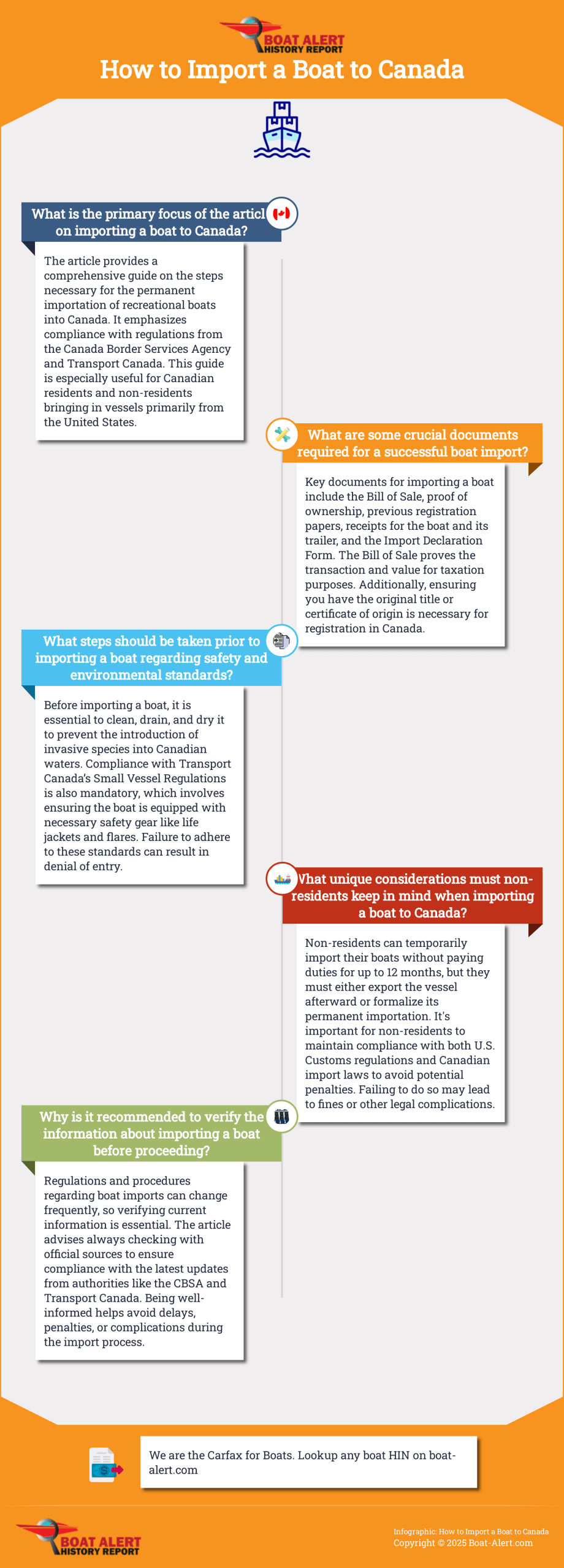

Importing a boat to Canada can be a straightforward process if you’re prepared with the right documentation and knowledge of regulations. This guide focuses on permanent imports of recreational or pleasure craft boats (e.g., motorboats, sailboats, or personal watercraft) for personal use, primarily from the United States, as that’s the most common scenario. Whether you’re a Canadian resident bringing home a new purchase or a non-resident planning to relocate your vessel, understanding the steps ensures compliance and avoids delays or penalties. Note: This information is current as of August 2025; always verify with official sources for the latest updates.

Key Takeaways

- Compliance with Canada Border Services Agency (CBSA) and Transport Canada regulations is essential for smooth entry.

- Gather all required documents, including proof of ownership and sales receipts, before crossing the border.

- Expect to pay applicable taxes like GST/HST and possibly provincial sales taxes; duty may be waived under trade agreements.

- Trailers often require separate import procedures through the Registrar of Imported Vehicles (RIV).

- Environmental inspections are mandatory to prevent invasive species—clean, drain, and dry your boat before arrival.

- For U.S. sellers, notify U.S. Customs at least 72 hours in advance for exports.

Understanding the Boat Import Process in Canada

Importing a boat typically involves purchasing the vessel abroad (often in the U.S.), preparing documentation, declaring it at the border, paying fees, and registering it in Canada. The process differs slightly for overland transport (e.g., trailered boats) versus arrival by water.

For Canadian residents importing a marine pleasure craft, you must report to the CBSA upon arrival. If entering over water, use a designated marine reporting site and call the Telephone Reporting Centre (TRC) at 1-888-226-7277 for clearance. For trailered boats crossing land borders, declare at a highway port of entry.

Key steps include:

- Pre-Import Preparation: Verify the boat’s eligibility (e.g., no restrictions on certain types) and ensure it meets Canadian safety and environmental standards.

- U.S. Export Notification (if applicable): Fax or submit the boat’s title to U.S. Customs at least 72 hours before export for a title search and stamp. This applies to vehicles exported by vessel, aircraft, or land border. Present the stamped document to CBSA.

- Border Declaration: Declare the boat and provide documents; pay taxes and duties.

- Post-Import: Register and license the boat in your province, and complete any required inspections.

Failure to declare can result in fines, seizures, or denial of entry. Non-residents may import temporarily without duties for up to 12 months, but must export or formalize permanent import afterward.

Requirements for Boat Import to Canada

To import successfully, focus on documentation, declarations, and compliance. Boats manufactured in the U.S., Canada, or Mexico are generally duty-free under the Canada-United States-Mexico Agreement (CUSMA).

Essential Documents

- Bill of Sale: Signed document detailing the purchase, including price, buyer/seller info, and boat description (e.g., make, model, hull identification number – HIN).

- Proof of Ownership: Original title or certificate of origin; if from the U.S., include the stamped export copy.

- Registration Papers: Previous registration or licensing documents.

- Receipts: For the boat, trailer, and any equipment.

- Import Declaration Form: Completed at the border (e.g., Form E15 for temporary imports or B3-3 for permanent).

If the boat is financed or leased, provide lien release letters.

Environmental and Safety Compliance

Canada enforces strict rules to protect waterways from invasive species like zebra mussels. Before entry, clean, drain, and dry your boat thoroughly—failure may lead to denial. Boats must comply with Transport Canada’s Small Vessel Regulations for safety equipment (e.g., life jackets, flares). Inspections may be required.

| Document/Requirement | Description | Importance |

|---|---|---|

| Bill of Sale | Signed purchase details | Proves transaction and value for taxes. |

| Proof of Ownership | Original title/certificate | Confirms legal ownership; required for registration. |

| U.S. Export Stamp | From CBP, if applicable | Verifies U.S. compliance for exports. |

| Customs Declaration | Border form (e.g., B3-3) | Declares value and initiates tax payment. |

| Environmental Certification | Proof of cleaning | Prevents invasive species; mandatory inspection. |

| Luxury Tax Form (if >$250,000) | CRA filing | Additional tax on high-value vessels. |

How to Import a Boat from the US to Canada

This is the most common route due to proximity. After purchase:

- Obtain U.S. export approval: Submit title to U.S. Customs 72 hours in advance for verification (no cost, but required to prevent theft checks).

- Transport the boat: Trailer it or ship by water/vessel.

- At the Canadian border: Declare the boat/trailer, present documents, and pay fees. CBSA will assess value based on your bill of sale.

- Pay taxes: GST (5% federal) plus provincial taxes (e.g., PST in BC at 7-12%, HST in Ontario at 13%).

- Register in Canada: Obtain a Pleasure Craft Licence (free for 10 years) or provincial registration.

For returning U.S. boats (e.g., after temporary export), the process is simpler: inspection and serial checks, with fees paid in your home state. Currency exchange may make U.S. purchases attractive, but factor in import costs.

Boat Import Duties and Fees in Canada

Duties are often zero for qualifying boats, but taxes apply to the purchase price (including transport costs to the border).

Types of Taxes

- Goods and Services Tax (GST): 5% federal tax.

- Provincial Sales Tax (PST): Varies (e.g., 7% in BC, 8% in Manitoba; none in Alberta).

- Harmonized Sales Tax (HST): Combined in provinces like Ontario (13%), Nova Scotia (15%).

- Luxury Tax: For boats over $250,000, pay the lesser of 10% of full value or 20% of amount above $250,000. This tax, introduced in 2022, remains in effect in 2025 despite advocacy for repeal. Exemptions may apply for commercial use or exports.

Cost Estimations

Expect 5-15% in total taxes on the boat’s value. Additional fees: RIV inspection (~$200-300 for trailers), provincial licensing ($50-200).

| Cost Type | Description | Estimated Rate |

|---|---|---|

| GST | Federal tax | 5% |

| PST | Provincial (varies) | 0-10% |

| HST | Combined in some provinces | 13-15% |

| Luxury Tax | For vessels >$250,000 | 10-20% of excess/full |

| RIV Fee (Trailer) | Inspection for <15-year-old trailers | $200-300 |

| Duty | Trade agreement exemptions | Often 0% |

Budget extra for shipping, inspections, and currency fluctuations.

Canadian Boat Import Regulations

Regulations protect safety, environment, and trade. Key aspects:

- Inspections: CBSA may inspect for compliance; trailers under RIV program require federal inspection within 45 days.

- Restrictions: Prohibited if stolen, unsafe, or carrying invasives. Commercial vessels follow different rules.

- Temporary Imports: No taxes for <12 months; declare and get a temporary permit.

Consult CBSA for specifics.

Steps for Importing a Trailer with Your Boat

Trailers are treated as vehicles:

- Verify VIN and ensure <15 years old for RIV eligibility.

- Include trailer in border declaration; pay separate taxes.

- Submit RIV e-Form online before arrival (~$200 fee).

- Get inspection at an authorized center (e.g., Canadian Tire) within 45 days.

- Register provincially.

Older trailers (>15 years) skip RIV but still need declaration.

Importing a boat to Canada requires planning, but following these steps ensures a hassle-free experience. Start by consulting the CBSA website or a customs broker for personalized advice. With proper preparation, you’ll soon enjoy Canada’s stunning waterways.

FAQ

What documents do I need?

A bill of sale, proof of ownership, title, and receipts. For U.S. exports, include the 72-hour stamped notice.

Are there duties?

Often none for U.S./Mexico-made boats under CUSMA.

What about luxury tax?

Applies to boats over $250,000; calculate via CRA tools.

Do I need to declare if entering by water?

Yes, report to TRC at least 72 hours in advance for private boats.

How do I estimate costs?

Use the boat’s value plus taxes (5-15%); add ~$300 for RIV if trailered.

Can I import other vessels?

This guide is for pleasure craft; commercial or other types may have additional rules.

Where to get more info?

Visit CBSA.ca, RIV.ca, or contact a customs expert.

Did you know about 10,000 boats enter Canada yearly? Importing a boat to Canada might seem hard, but it’s doable with the right info. Whether you want to explore Canada’s waters or bring a personal watercraft, knowing the import process is key. It includes declaring your boat at the border, having all necessary documents, and following customs rules.

Each step is important for a great boating experience. So, it’s crucial to go through this process carefully.

Key Takeaways

- Understanding the import process helps ensure compliance with Canadian regulations.

- Proper documentation is essential for a smooth entry into Canada.

- Customs duties and taxes must be considered during planning.

- Familiarity with declared borders is crucial for a hassle-free experience.

- Awareness of Canadian regulations enables informed decision-making.

Importing a boat from the U.S. to Canada involves securing the original title and sales receipts for the boat and equipment. A copy of the boat’s title must be faxed to U.S. Customs 72 hours before crossing the border. U.S. Customs will perform a title search and stamp the document, which is then presented to Canadian Customs. Buyers pay PST and can license the boat in Canada.

If importing from Canada to the U.S., the process is similar but simpler. The boat is inspected, and serial numbers are checked upon returning to the U.S. Buyers only pay fees after returning to their home state.

However, U.S. buyers rarely purchase boats from Canada due to the currency exchange rates, as it is often cheaper to buy within the U.S. Despite concerns, experts agree the process is straightforward and recommend consulting Canadian Customs, the Registrar of Imported Vehicles, and insurance agents for guidance.

Understanding the Boat Import Process in Canada

Importing a boat from the US to Canada is a detailed process. It starts with buying your boat and learning about key steps.

First, gather all needed documents. This includes the bill of sale, proof of ownership, and any past registration papers. Knowing what’s required for importing a boat in Canada is vital. Keep these documents ready, as border authorities will ask for them when your boat arrives.

The Canada Border Services Agency (CBSA) says you must declare your boat when entering Canada. Not doing so can lead to fines and problems with the import process. Knowing and following these rules helps you enjoy your boat smoothly.

Also, be ready for taxes and fees. Learning about these costs helps with your budget for your new boat.

Requirements for Boat Import to Canada

To import a boat to Canada, you need to gather important documents and follow certain rules. You must have a signed bill of sale that shows all the details of the sale. Also, you need proof of ownership and the original title documents for a smooth process.

When you get to the border, you must declare your boat and any trailers. You might also have to pay federal and provincial taxes based on the boat’s value. Knowing the Canadian boat import rules is key. These rules often let boats made in Canada, Mexico, or the U.S. avoid federal duty due to trade agreements.

It’s also important to know about luxury taxes for boats worth over $250,000. Knowing about these fees can help you budget better.

| Document/Requirement | Description |

|---|---|

| Bill of Sale | A signed document detailing the purchase of the boat. |

| Proof of Ownership | Documentation confirming rightful ownership of the vessel. |

| Original Title Documents | Document stating the title of the boat, necessary for registration. |

| Customs Declaration | Declared at the border for all imported boats and trailers. |

| Tax Payment | Federal and provincial taxes based on the boat’s value. |

| Luxury Tax (if applicable) | Additional tax for vessels exceeding $250,000 in value. |

How to Import a Boat to Canada

Importing a boat to Canada needs careful planning and the right documents. Start by declaring any cash if you’re paying in person. After buying, check the title documents and make sure the seller owns the boat.

When you get to the Canadian border, tell them about your boat. You’ll need to pay taxes during the import process. Knowing about boat import duties Canada and other fees helps avoid surprises.

Following these steps can make importing a boat easier. It helps you enjoy your new boat without problems.

Declarations and Documentation Needed

Knowing what documents you need is key for a smooth boat import in Canada. You’ll need proof of ownership and declaration forms for the border. Getting these right can avoid delays and make the import easier.

Bill of Sale and Ownership Proof

A bill of sale is the main proof you bought the boat. It should show the purchase details, like the price for the boat and trailer. In Canada, you might also need a Certificate of Title to prove you own it. Having these documents right helps the import go smoothly.

Importation Declaration at the Border

When you get to the Canadian border, you must declare your boat’s value. You’ll need to show your bill of sale and ownership proof to the customs officer. Declaring the right value helps avoid legal trouble and is wise to bring supporting documents.

| Document | Description | Importance |

|---|---|---|

| Bill of Sale | Records the purchase transaction and details. | Essential for proving ownership and value. |

| Certificate of Title | Proof of ownership issued by the previous jurisdiction. | Establishes legitimate ownership rights. |

| Importation Declaration | Form submitted to customs upon crossing the border. | Required to declare the boat and its value for tax purposes. |

Importing a Boat from the US to Canada

Importing a boat from the US to Canada is a journey with specific steps. First, make sure you’ve bought the boat and its trailer. You’ll need to gather important documents like proof of ownership and receipts.

Then, meet the requirements for boat import Canada. Customs will look at your Bill of Sale and title to confirm you own the boat. Also, check that your trailer has a valid VIN and is registered. Customs will inspect these during the border crossing.

Before crossing the border, know about the boat import duties Canada. Learn how these duties are figured out and the sales tax for your province. Be prepared for extra costs during registration.

Understanding these key points helps you have a smoother boat import journey from the US to Canada.

Boat Import Duties and Fees in Canada

Knowing about boat import duties in Canada is key for anyone bringing a vessel here. It’s important to know the taxes for boat import, as they can change your total cost. You’ll face both federal and provincial taxes, with rates depending on where you are.

Types of Taxes Involved

When you import a boat, you’ll face different taxes based on your province. You’ll see:

- Goods and Services Tax (GST): A federal tax across Canada.

- Provincial Sales Tax (PST): Charged in some provinces, like Ontario’s 8%.

- Harmonized Sales Tax (HST): A mix of GST and PST in places like New Brunswick, at 15%.

Different areas have different rules. For example, Alberta doesn’t have a sales tax, which is good for boat imports. It’s important to document your costs clearly to avoid issues with boat and trailer expenses.

Cost Estimations for Importing

Calculating boat import costs needs careful planning of all fees. Here’s a simple guide to costs:

| Cost Type | Description | Estimated Percentage |

|---|---|---|

| GST | Federal tax on the purchase price | 5% |

| PST | Provincial tax in provinces that charge it | Varies (up to 10%) |

| HST | Used in areas with combined tax rates | 13% – 15% |

| Licensing Fees | Registration fees for the boat | Varies by province |

Understanding these costs helps you prepare for the financial side of importing a boat in Canada. This way, you can make smart choices about your purchase.

Canadian Boat Import Regulations

Importing a boat to Canada requires knowing the rules. Canada wants to keep its waters safe from harmful species. The Canada Border Services Agency (CBSA) has strict rules for boat imports. Knowing these rules helps make the import process easier.

Before you bring your boat, check a few things:

- Inspection Requirements: Boats might need checks to meet environmental rules.

- Documentation: Make sure you have all needed papers, like ownership proof and bills of sale.

- Restrictions on Vessels: Some boats might not be allowed. Check if your boat is okay to bring.

Following Canadian boat import rules is a must. It keeps everyone safe and protects the environment. Knowing these rules helps you enjoy boating in Canada.

| Regulation Aspect | Details |

|---|---|

| Inspection Requirements | Mandatory inspections to ensure compliance with environmental standards. |

| Documentation Needed | Proof of ownership, bills of sale, inspection certificates. |

| Type of Vessels | Restrictions may apply to certain boats, verify eligibility before import. |

Steps for Importing a Trailer with Your Boat

Importing a trailer with your boat requires several important steps. First, make sure the trailer has a valid Vehicle Identification Number (VIN). This number is key for customs clearance and makes the import process easier.

When you reach the border, have the trailer’s title ready. You’ll also need to fill out the RIV (Registrar of Imported Vehicles) forms. If your trailer is under 15 years old, it might need a secondary inspection. This can usually be done at places like Canadian Tire, which is convenient.

To guide you through the steps to import boat trailer, here’s a quick checklist:

- Verify the trailer has a valid VIN.

- Gather the trailer’s title for border presentation.

- Complete all necessary RIV forms.

- Prepare for a secondary inspection if the trailer is under 15 years old.

- Ensure compliance with all requirements for boat import Canada.

By following these steps, you’ll have a smoother experience when importing a trailer with your boat into Canada.

Conclusion

Importing a boat to Canada can be easy if you know what to do. Learning about the boat import process in Canada helps a lot. It makes moving your boat across the border smoother.

Knowing the Canadian boat import rules and costs is key. This knowledge helps you avoid surprises and follow the law. Understanding these points makes owning a boat in Canada a real possibility.

If you need help, talking to customs experts is a good idea. They can make the import process easier and help avoid problems. This way, you can successfully bring your boat to Canada.

#import #boat #Canada

FAQ

What documents do I need to import a boat to Canada?

To bring a boat into Canada, you need a few important documents. You’ll need a signed bill of sale and proof of ownership. Also, you must have the original title documents ready for border declaration.

Are there any duties or taxes when importing a boat from the US to Canada?

Yes, there are duties and taxes involved. You might have to pay GST, PST, or HST, depending on where you are in Canada. Boats made in Canada, Mexico, or the U.S. might not face federal duty due to trade agreements.

What are the key steps in the boat import process in Canada?

The process starts with buying the boat. Then, you gather all needed documents. Next, declare the boat at the border and pay any duties and taxes. Make sure to follow Canadian rules to avoid penalties.

Is it necessary to declare my boat at the border?

Yes, declaring your boat at the Canada Border Services Agency (CBSA) is required. Accurate declaration helps follow regulations and avoids legal trouble.

How do I estimate the costs involved in importing a boat?

Costs vary widely. They include federal and provincial sales taxes, and luxury taxes for expensive boats. Remember to separate costs for the boat and trailer for accurate duty calculation.

What are the Canadian boat import regulations I should be aware of?

Canadian regulations cover legal requirements for documentation, inspections, and restrictions. Knowing these rules helps ensure a smooth import process.

What should I know about importing a trailer with my boat?

The trailer must have a valid VIN. You’ll need the trailer’s title and complete customs clearance forms. Check if a secondary inspection is needed based on the trailer’s age.

Can I import boats other than marine pleasure crafts?

The information mainly applies to marine pleasure crafts like boats and personal watercraft. Different rules might apply to commercial vessels or other types of boats.

Where can I find more information on boat import requirements?

For detailed information, visit the Canada Border Services Agency (CBSA) website. You can also consult with customs experts to ensure you meet all requirements.

If you’re an importer running an import/export business in British Columbia, Ontario, or the Maritimes, working with a border agent or consulting border experts can save you from costly mistakes. Whether you’re moving goods between countries or bringing in a pleasure craft that needs a pleasure craft license and a trailer license, proper paperwork is essential—from customs forms and invoices to understanding tariff rules and potential embargoes. Enrolling in a customs specialist program can give you the skills to manage these processes yourself, but many still rely on professionals to calculate shipping costs, verify documentation, and even coordinate with a mechanic for compliance inspections. In the end, smooth border crossings come down to preparation, knowledge, and meticulous attention to detail.

References:

- https://www.reddit.com/r/boating/comments/1fz93zu/has_anyone_bought_and_imported_a_used_boat_from/

- https://borderbuddy.com/blog/how-to-import-a-boat-into-canada

- https://www.cruisersforum.com/forums/f57/importing-a-boat-to-canada-267956-3.html

- https://www.help.cbp.gov/s/article/Article-1283

- https://www.cruisersforum.com/forums/f57/importing-a-boat-to-canada-267956.html

Categories: To learn more about Boat-Alert.com History Reports for used boats and find history of hull numbers visit: www.Boat-Alert.com